Performance-based component that may be paid in the form of cash or shares in talent. Conveyance allowance above Rs.

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

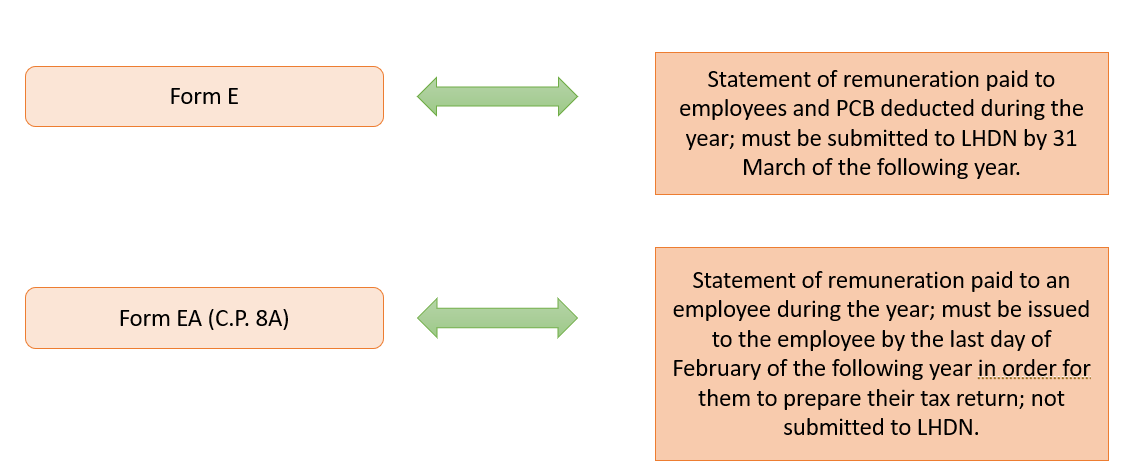

What are the types of income which are taxable and subject to Monthly Tax Deduction MTD or in Bahasa Malaysia Potongan Cukai Berjadual PCB.

. The non-universal principle is used to give the provision of allowances to the identified groups or services. At least 90 days in aggregate during the 9 months before her confinement. Maternity leave As of Malaysias Budget 2020 90-days of maternity leave was proposed by the Government for employees working in the private sector.

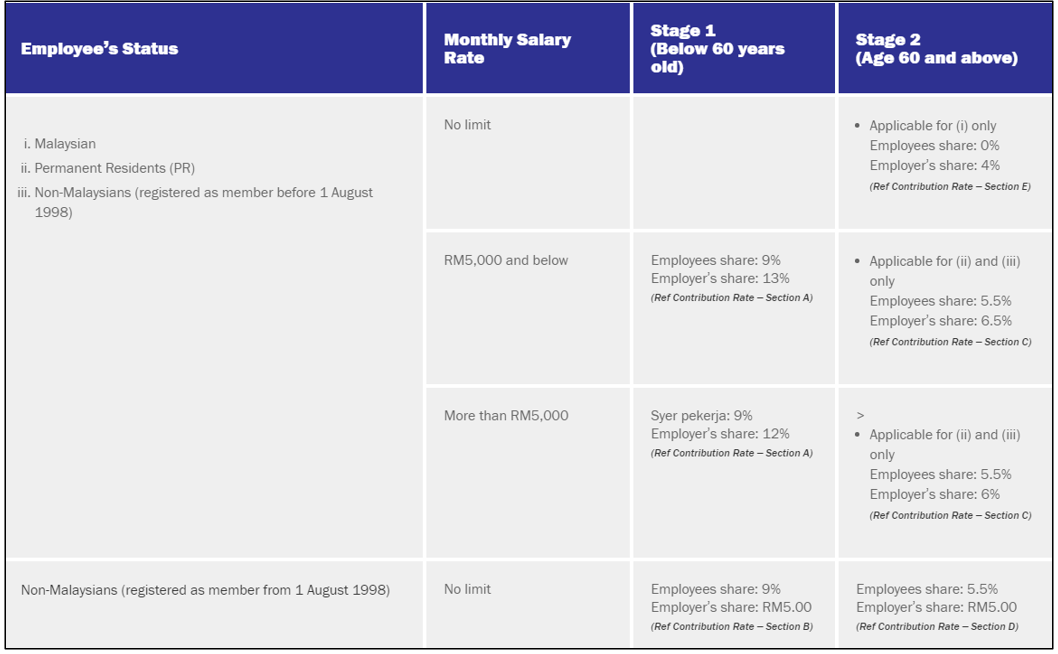

The allowances which are paid to the employees by employers forming a part of the salary but are fully exempted from taxes are called non taxable allowances. Provident Fund employees under the age of 60 400-650 Provident Fund employees over the age of 60 175 Social Security SOCSO 020 Employment Insurance EIS monthly salary ceiling of 5000 MYR 100 Human Resource Development Fund over 10 employees 1895-2245 Total Employment Cost Employee Employee Payroll Contributions. Mandatory employee benefits bare minimum and AMAZING.

These benefits are considered bare minimum but some companies dont even do them. Lets cover the first one the mandatory employee benefits in Malaysia. Besides the mandatory benefits they are also offering a lot more optional benefits such as.

This time is allowed for physical needs of the worker. Other mandatory benefits outlined in the Act include. 11 minutes Editors note.

Sick leave Hospitalisation leave Lay-off benefits. The employment income for women returning to work after a career break of at least 2 years is exempted for up to a maximum of 12 consecutive months application to Talent Corporation Malaysia Berhad by 31 December 2023 and the exemption period is until YA 2024. 1600 per month Rs.

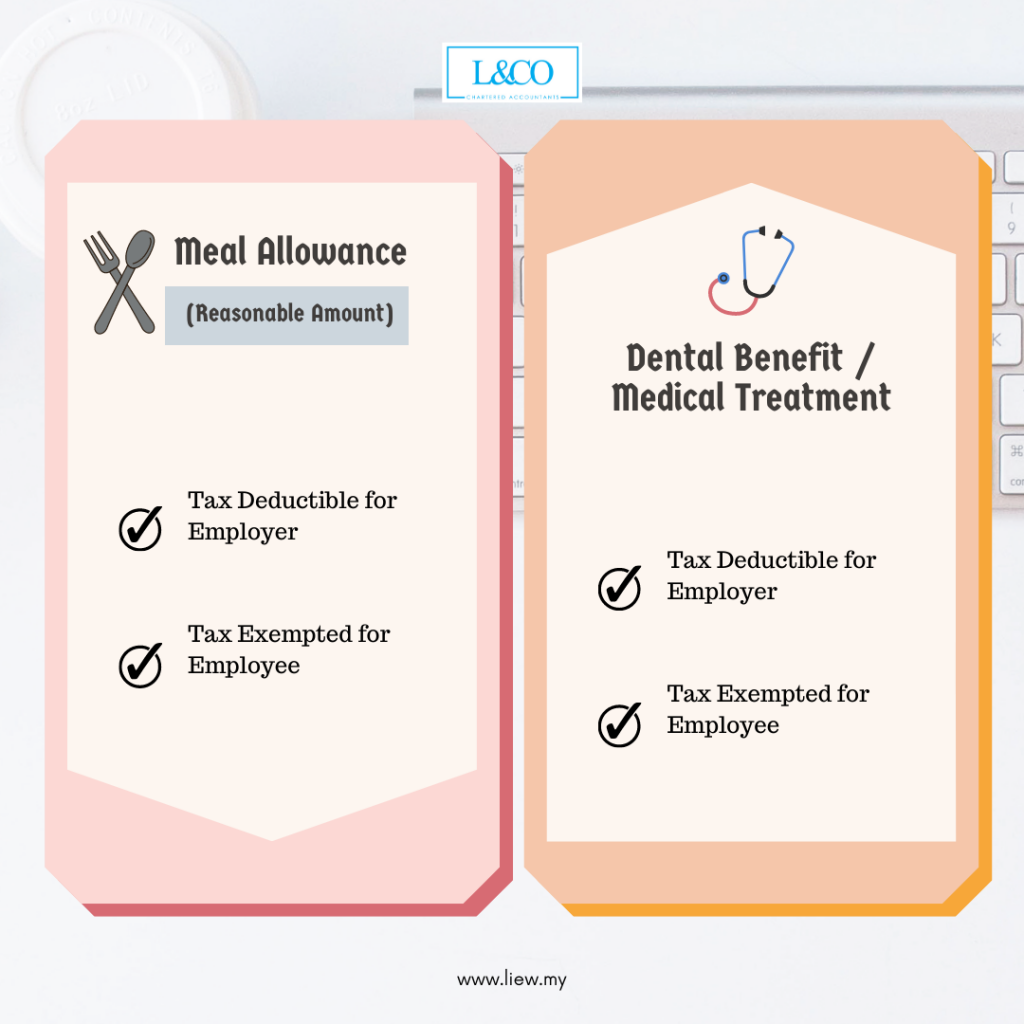

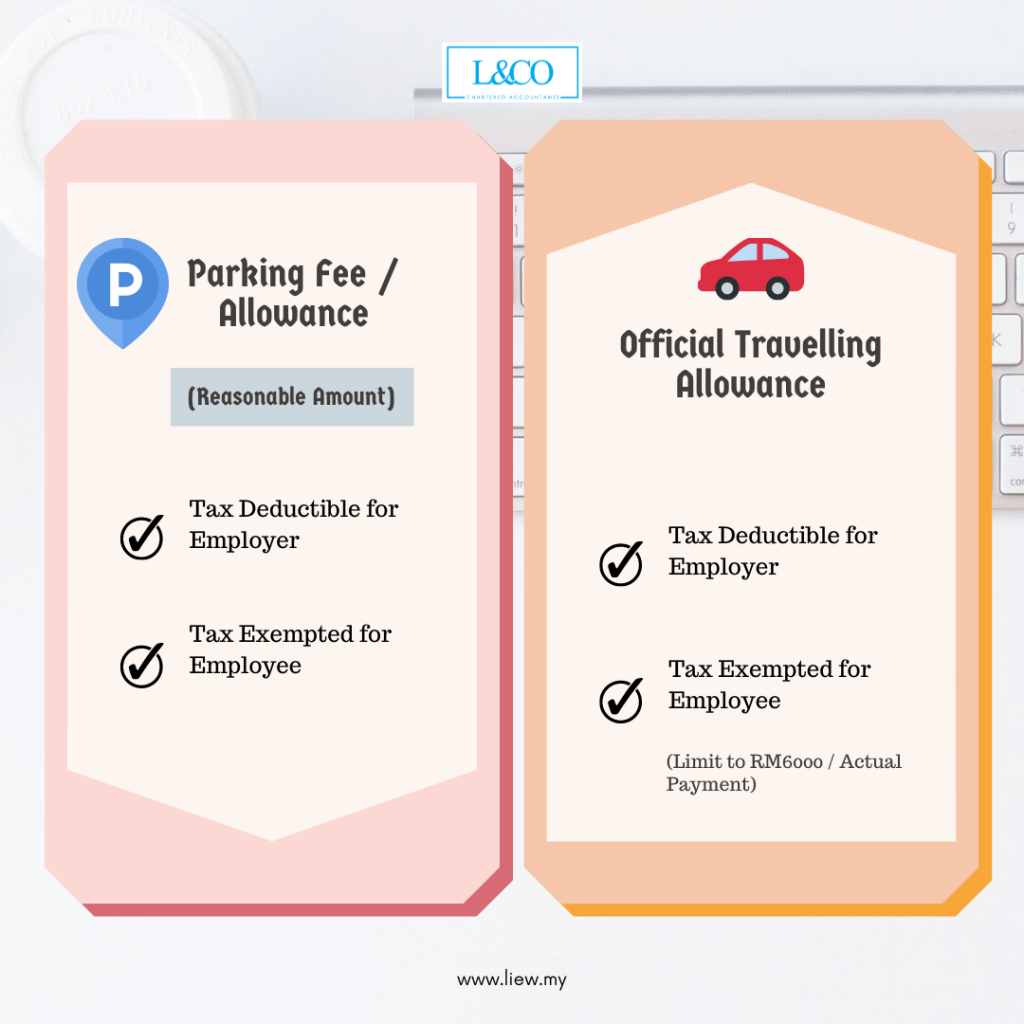

More than RM 6000 may be claimed if records are kept for 7 years. Any expense over and above that is taxable. Is Allowance Taxable in Malaysia - bisaeu Meal allowance is paid according to the position duties or place where the employment is performed by the employee.

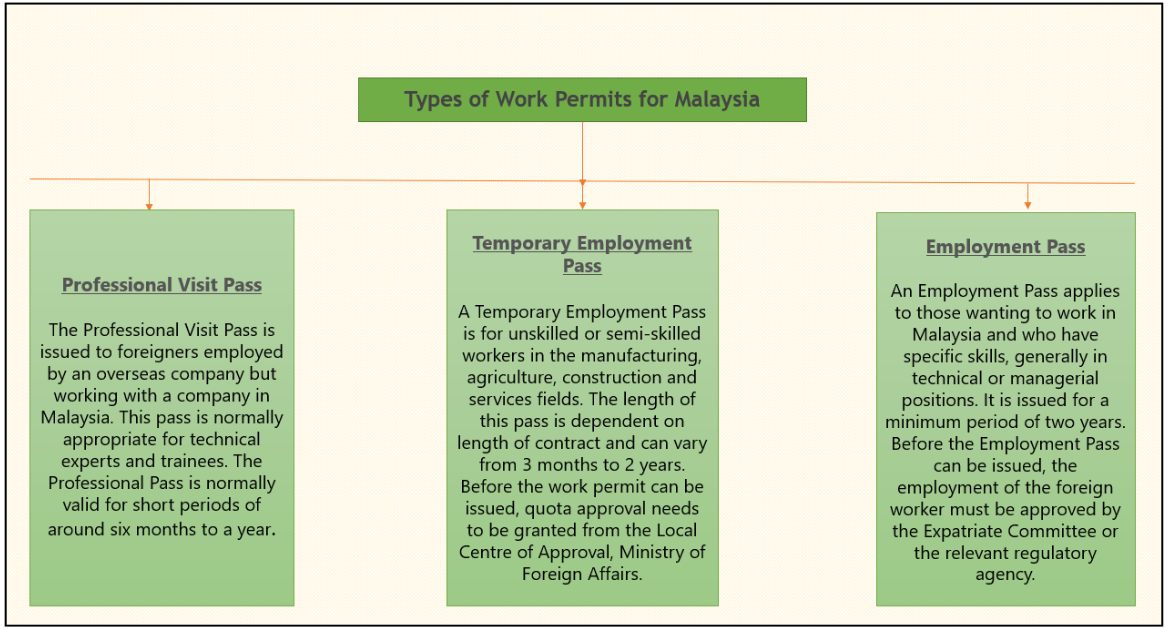

Job search allowance early re-employment allowance reduced income allowance training allowance and training fee. This came into effect on 1 January 2021. Types of employment income Cash remuneration does not include equity-based income.

The lists of non taxable allowances are as follows-. The allowance amount is calculated on the basic salary of the employee. DA is fully taxable with salary.

The Malaysian GDP grew at an average of 65 per annum for almost 50 years complemented by its amazing geographic location and multilingual mix of Malay Indian and Chinese populace. Some employers offer group private health insurance group life insurance and group accident insurance as a monthly allowance for employees. AND She was employed by the employer at any time in the four months immediately before her confinement.

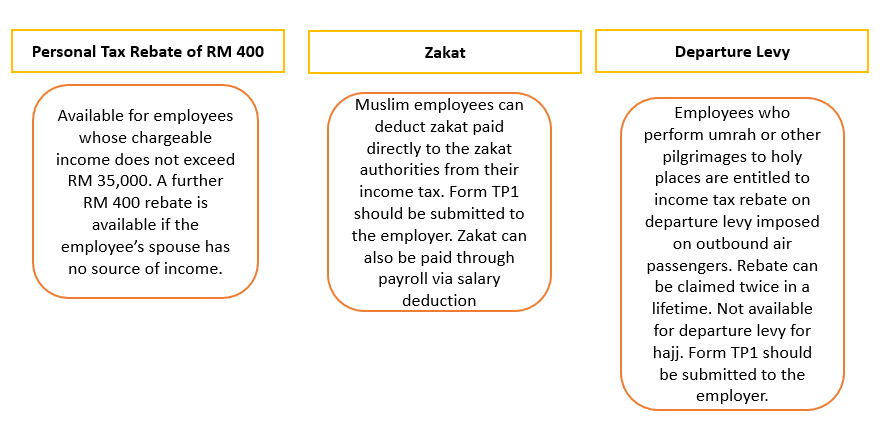

The main components that shall form the remuneration of Directors and Senior Management are set out below-. An allowance is a fixed amount received by a salaried employee from his employer to meet specified needs or expense other than hisher basic salary. Here are the 14 tax exempt allowances gifts benefits perquisites.

Non Taxable Allowances. Must-know Malaysia Leave Types and Overtime Pay Rates is an article written by Nan An and further updated by Hern Yee from Talenox. According to the law the basic pay will be 30 to 60 of the salary.

The allowance is paid to the employees to manage the inflation. 19200 annually is provided to the employees for commuting from home to office and vice-versa. Dearness Allowance DA is an allowance paid to employees as a cost of living adjustment allowance.

Types of Employee Benefits in Malaysia I would categorise employee benefits in Malaysia into two types. Monthly payment to Directors which forms basic salary. Such allowances are mostly paid to the government employees.

Thanks to useful features like the Documents module you can upload important documents for employees to view such as employee handbooks employment contracts or even a Performance Improvement Plan. The principles underlying the provisions of allowances in the Malaysian public sector are outlined in the Cabinet Committee Report 1976 JKK 1976 and New Remuneration System which are. Types of income under section 131 of the Act states that the gross income of an employee concerning gains or profit from an employment includes- covers monetary forms such as wages salary remuneration leave pay fee.

However there are exemptions. 19200 per annum under section 10 14 ii of income tax act An amount of Rs. However depending on the type of allowance some LHDN tax deductions apply and you can meet the expectations of senior management and employees.

Travelling allowance petrol allowance toll rate up to RM6000 annually Parking allowance Meal allowance Child care allowance of up to RM2400 annually. The LHDN provides for perquisites from employment under Public Ruling No. Just like Benefits-in-Kind Perquisites are taxable from employment income.

A lot of companies in Malaysia are waking up. A worker does not work continuously like a machine and hence personal allowance is provided to him in order to satisfy his personal requirements like. Insurance medical life dental or optical Parking allowance Internet or mobile allowance Personal or professional training Employment injury coverage SOCSO Additional paid leave Additional paternity leave.

KUALA LUMPUR Aug 1 The government has listed four types of allowances for retrenched workers under the newly proposed Employment Insurance Scheme EIS hoped to take effect beginning January 1 next year. Petrol allowance petrol card travelling allowance or toll payment or any combination Tax exempt up to RM 6000 per year only if used for official duties. The latter is a useful tool to employ before considering termination which can help employees to resolve potential issues and perform to the best of their abilities.

Restrictions for Benefits and Compensation Another crucial part of Malaysia compensation laws is learning the restrictions for benefits and pay. An employer is required to pay maternity allowance ie payment of her salary for that 60 consecutive days to an employee if she has been employed by that employer for.

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

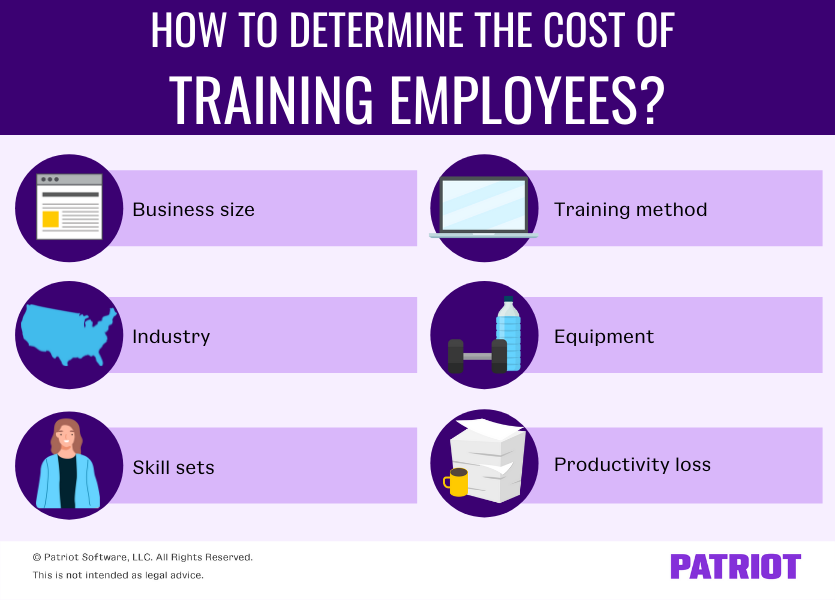

What Is The Cost Of Training Employees Factors How To Calculate

Employee Benefits Definition With 8 Types And Examples

Everything You Need To Know About Running Payroll In Malaysia

.jpg)

Importance Of Issuing A Payslip In Malaysia Insights Propay Partners

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

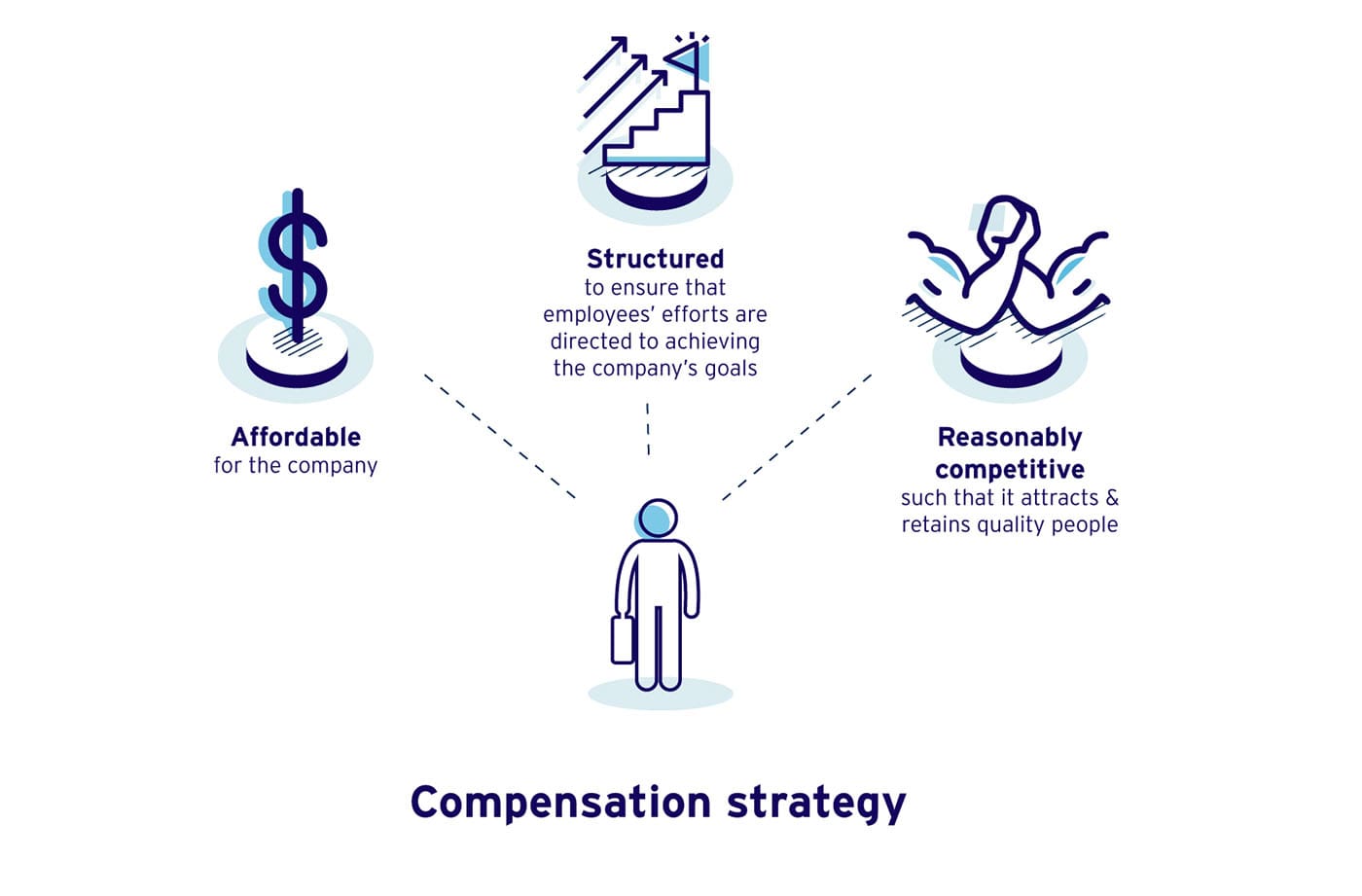

Employee Compensation Salary Wages Incentives Commissions Entrepreneur S Toolkit

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Payslip Template Free Word Templates

Payslip Template Format In Excel And Word Microsoft Excel Templates

Everything You Need To Know About Running Payroll In Malaysia

Salary Slip Template Free Payslip Templates

Payroll Template Free Employee Payroll Template For Excel